The digital ecosystem in Iran is grappling with multifaceted challenges. Macroeconomic pressures, security-driven policies, and ongoing technical disruptions have all significantly affected both users and businesses. At the same time, the government has intensified restrictions on financial transactions and increased pressure on cryptocurrency exchanges. These moves signal a clear intent to tighten control over the digital space and diminish its independence..

On the other hand, frequent network disruptions, especially during off-peak hours, raise questions about the quality and reliability of digital services, eroding user trust. These two trends together create a complex environment for sustainable development and innovation within Iran’s digital ecosystem.

A comprehensive analysis of Iran’s digital landscape in March reveals that it is facing a combination of political, economic, and technical challenges. Government policies have increasingly taken a control-oriented approach, aiming to restrict the sector’s autonomy and stifle its dynamism.

Concurrently, frequent network access problems and service disruptions negatively affect user experiences. Particularly, disruptions in widely used essential digital services can seriously impact economic growth, social participation, and civil rights. Addressing these challenges requires transparency in policymaking, investment in sustainable infrastructure, and respect for users’ digital rights.

Network Conditions and Disruptions

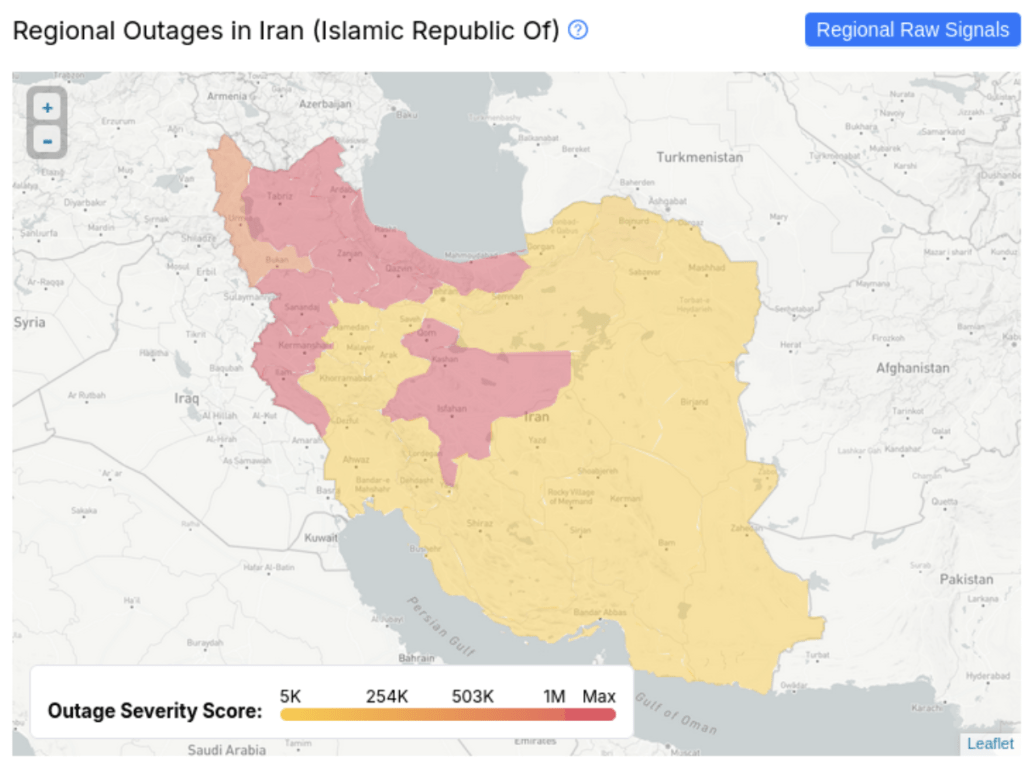

Analysis of network disruption data from March highlights instability and significant connectivity challenges in Iran. Although most disruptions had regional impacts affecting a moderate number of users, their frequency and nature raise considerable concerns.

- Geographic Spread and Frequency of Disruptions: Half of the recorded disruptions (50%) affected multiple provinces, indicating vulnerability in the country’s regional network infrastructure. Additionally, reports from Filterwatchshow major operators such as Irancell and Telecommunication Company of Iran experienced the highest frequency of disruption days, questioning overall national network stability.

- Disruptions in Essential Services: Approximately 40% of the recorded disruptions impacted highly-used and critical services such as banking and messaging, seriously affecting daily life and economic activities. Such disruptions undermine user trust in digital platforms and can cause significant financial losses for businesses.

- Timing to Reduce Impact: Notably, all recorded disruptions occurred during off-peak hours (late night or early morning), likely an attempt to minimize user impact per incident. However, disruptions during these times still significantly affect active users.

- Varied Scale of Disruptions: Data shows 45% of disruptions affected between 500,000 to one million users (medium scale). Another 35% were smaller scale, affecting fewer than 500,000 users. Only 20% were large scale, affecting more than one million users. This variation suggests disruptions could be both targeted regionally and broadly incidental.

- Duration of Disruptions: Duration varied significantly. While 50% lasted less than one hour, 40% lasted between one hour and one day, and 10% exceeded one day. Longer disruptions raise deeper concerns about infrastructure stability or intentional network outages.

- Social and Political Factors: Although 90% of disruptions were not directly linked to major social or political events, their indirect and contextual influence cannot be overlooked. For instance, reports of disruptions in VPN access and local outages due to armed conflicts, such as those on March 8, 2025, in Izeh town between Abol Korkor and Iranian security forces, highlight potential connections between socio-political events and network problems. About 10% of disruptions were related to protests.

Policymaking and Its Impacts

Policies enacted by governmental and governing institutions in March 2025 illustrate a controlling and interventionist approach towards Iran’s digital space. Central bank restrictions on remote corporate withdrawals, pressure on cryptocurrency exchanges to provide user data, and overarching economic and security policies indicate diminishing economic independence in the digital sector, steering it towards reliance on government resources.

- Liquidity Control and Market Intervention: Central bank restrictions, besides disrupting business operations and increasing their operational costs, demonstrate selective market management. Lack of transparency in lifting these restrictions for certain entities highlights discriminatory monetary policies, paving the way for targeted governmental interventions.

- Privacy Threats and Potential Suppression: Pressure on cryptocurrency exchanges to disclose user information significantly threatens privacy. Considering past political account freezes, widespread data collection under the guise of “taxation” could become a tool for suppression, further eroding public trust in digital financial systems.

- Weakening the Startup Ecosystem and Accelerating Brain Drain: Iran’s macroeconomic and security policies have shifted the startup landscape away from innovation and toward increased reliance on the state. Declining private investment, government acquisition of equity in startups, and growing control over investment funds have all undermined competitiveness. As a result, many skilled professionals are opting to leave the country in search of better opportunities abroad.

- Increasing Access Costs and Strengthening Monopoly: Internet tariffs in Iran have increased, while the Infrastructure Communications Company continues to rely heavily on revenue from service operators. This economic burden falls on users and reinforces monopolistic dynamics in the sector. Given Iran’s already restricted internet access, increased costs further hinder citizens’ freedom to access information.

- Challenging Economic Autonomy of the Digital Sector: Security restrictions and diminished competitive capabilities of digital companies have seriously challenged the economic autonomy of this sector. Exclusion of Iranian startups from international markets, intensified governmental monitoring, and restrictions on digital companies entering the stock market create an environment where centralized control supersedes innovation and independence.